Final installment of the Big Churn series, exploring how to better optimize your retirement portfolio for maximum growth & longterm sustainability, and why Target Date Funds can delay your retirement and leave you retiring with less.

- 09:42 - Basic Concept

- 15:51 - Post Retirement Glidepaths

- 31:32 - Pre Retirement Glidepaths

- 48:23 - How To Implement

- 58:50 - Caveats & Thoughts

Show Notes

Mentioned in episode

- 👺 The Optimizers Curse - guest post

- Equity Index Funds

- Bond Index Funds

- Other stable assets

- Gold - IAU

- Treasury Bonds - I-Bonds

- Cash - Wealthfront 5% (5.5% via referral)

- Simple google sheet to help with monthly portfolio rebalancing 👇

Select File > Make a Copy to get your own editable version!

📚 Suggested reading: Early Retirement Now

- Post-retirement Glidepaths: Part 1

- Post-retirement Glidepaths: Part 2

- Pre-retirement Glidepaths: 100% equities

- Why Target Date Funds suck

- [Extra Credit] Using gold as a hedge

Vanguard Glidepath vs BigERN's Glidepath

◀ Last time

- 🪜 The Big Churn: Roth Conversion Ladders - Episode 55

- ⚕️ The Big Churn: ACA Health Subsidies - Episode 53

🤖 AI Episode Highlights

The Perils of Financial Mistrust in Retirement Planning: "You know, you could be keeping your retirement savings in a checking account, which I recently found out is what my mom has been doing with some of her retirement funds. Like six figures worth of cash she has been keeping in a bank of America checking account for decades because she didn't trust the stock market. So, yeah, that was interesting conversation."

— Kai [00:02:54 → 00:03:19]

Retirement Planning Complications: "What if you didn't start contributing until later in life? What if 65 is only ten years away for you? What if you want to retire early? What if you want to retire 5, 10, 20, 30 years earlier than 65? Or what if you want to have money to leave your kids? Like you don't want full capital depletion by age 95? What if you plan to live past 100? The target date fund is not going to work for you, and in fact, is suboptimal on all of those fronts and even for traditional retirees."

— Kai [00:14:23 → 00:14:58]

Understanding Retirement Glide Path Variations: "And using that data, he's calculated the effect of different stock and bond allocations, ranging from 0% to 100%. And more importantly, what we care about is he's calculated the effect of 24 different glide path variations. So 24 different glide path slopes that could represent how you would adjust your stock and bond allocations as you age."

— Kai [00:19:18 → 00:19:44]

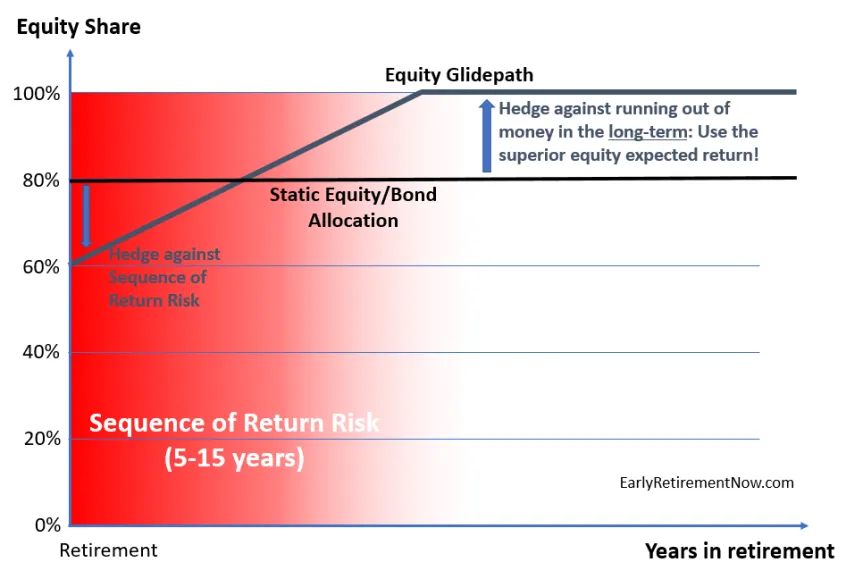

Optimal Retirement Allocation Strategy: "The best allocation strategy that will offer the highest portfolio performance over 60 years? Like, what will leave you with the most money when you die? And probably even more important is what has the least chance of going bankrupt, given that you need to withdraw from that portfolio every year during your retirement for such a long time frame. [...] The better approach, based on this newer analysis, is kind of counterintuitive. It's to do the opposite of that, to glide upwards."

— Kai [00:20:45 → 00:21:07]

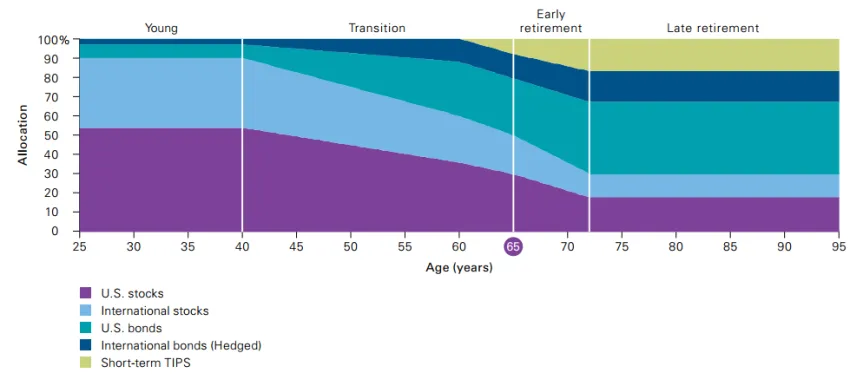

Understanding Target Date Funds: "And target day funds are designed the same kind of way, where there's just one fund for everyone and they're built for a very specific kind of retiree with a very specific retirement age who has a very specific risk profile and income and contribution profile, which we're going to dig into a little more. But these target date funds, you know, they start you off at 90% equities when you're young, when you're far away from retirement, and then they glide you down to roughly 67% equities when you're ten years away from retirement."

— Kai [00:35:16 → 00:35:52]

Retirement Planning and Flexibility: "And so to achieve that, the target date funds sacrifice performance to make sure you can retire on your retirement date no matter what. It's essentially a very costly insurance against market conditions that may otherwise cause you to delay your retirement. So if you have any flexibility in your retirement date, or if you're someone who's able to contribute a high amount into your retirement plan, like you're able to contribute 50% into your retirement plan instead of just 10%, if that's you chances are you could be doing a lot better than a target date fund by implementing your own custom glide path."

— Kai [00:38:13 → 00:38:55]

Retirement Investment Strategies: "With the glide paths we're discussing today that start you at 100% equities in pre retirement, that basically means you capture more of the market, the full effect of the market for longer. And in fact, depending on your life situation and your level of flexibility, it can even make sense to not glide down at all pre retirement. So holding 100% equity all the way through to your retirement date can also be a more optimal strategy, because if you have flexibility and a high contribution rate, if the market tanks right when you're planning on retiring, you would just delay for a few years. And during those few years, guess what's happening? You're contributing into a down market, which is one of the best things you can do for your retirement portfolio."

— Kai [00:42:08 → 00:43:02]

Strategies for a Secure Retirement: "And that means, basically that as you approach your five year planned retirement date, you hold less and less equities, which means less market exposure, which means less volatility, which means less risk that you'll have to delay your retirement. The added benefit of gliding down to 60% like that is that you're at the perfect starting point, then, for the post retirement glide path."

— Kai [00:43:27 → 00:43:51]

Investment Strategy Realities: "past performance is not indicative of future results. And the reason they say that is because that is true. You cannot predict the future using past data, but you can use the historical data as a starting point to sort of gauge your own level of risk and comfort."

— Kai [01:07:22 → 01:07:40]

Comments